What is wealth creation?

Wealth creation is the steady accumulation of income and assets over time. Growing wealth requires you to identify your financial and life goals and these should cover the short term (1-5 years), medium term (5-10 years) and long term (10+ years). Goals may include property ownership, funding private school or university education, saving for retirement. Having a clear prioritisation of your goals will help inform your wealth creation strategy.

Next, you need to plan – make a budget for your monthly expenses and include your savings and investments in the budget. Wealth accumulation for the medium to long term requires investing beyond basic bank savings accounts. This means you need to understand your attitude to risk so you can develop wealth creation strategies that align to your risk appetite as well as your goals.

Finally, successful wealth creation comes from correct asset allocation. This is all about where you place your investments – bonds, equities, real estate etc. For example, common wisdom is that you should only invest in equities if you can invest for the medium term at least five years. This is so you can afford to stay in when the market is going through any period of volatility. It’s advisable to have the help of a professional wealth manager to thoroughly assess all the options to find the best combination of investments for you.

What is wealth preservation?

Wealth preservation is the maintenance of your income and assets. This can be challenging as many people tend to be passive about wealth preservation. It can be difficult to preserve your wealth when markets are volatile. As you move towards retirement, most clients’ attitude to risk alters. Having high risk investments in later life puts you at risk of losing some or all your accumulated wealth, leaving you struggling through retirement. Diversifying your portfolio allows you to continue to secure good growth whilst taking a conservative approach to risk that ensures you maintain your wealth. Asset allocation should be regularly reviewed as the client ages and their personal circumstances change.

In addition to changing your investment strategy, having insurance and an emergency ‘rainy day’ fund of 3-6 months living expenses are also sensible options for wealth preservation. Protection policies enable you to insure your income against being unable to work through illness and critical illness policies can take the financial pressure away if you are diagnosed with a disease such as heart attack, cancer or a stroke. These insurances help to prevent your wealth from being eroded if life doesn’t go to plan.

How do you decide when to switch strategies?

The answer to this question is, of course, complicated and depends entirely on the individual’s circumstances, risk attitude and financial goals. But, to generalise, wealth managers tend to start to consider more of a wealth preservation approach when clients reach age 50, assuming retirement around 60-65. At this point, asset allocation can begin to transition from higher risk such as emerging markets equities into lower risk assets such as government or corporate bonds. Once retirement has occurred, the portfolio needs to deliver regular monthly income to enable the client to maintain their standard of living and this will require additional changes to further reduce the exposure to equities and increase the amounts held in income instruments and cash assets.

Advice from Blacktower Financial Management

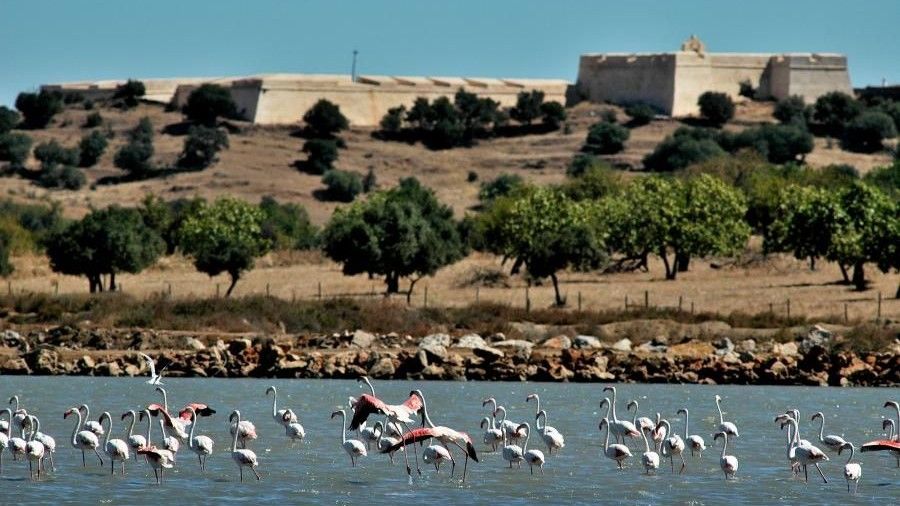

The choices for investing are limitless, but this can be overwhelming. Blacktower Financial Management wealth advisors can assess your situation, helping you to identify the best way to structure your wealth to grow and preserve your wealth. We will regularly review your position to ensure that you achieve your financial goals now and in the future. Contact one of the representatives at our Lisbon office today for your free no-obligation discussion.

Blacktower in Portugal

Blacktower’s offices in Portugal can help you manage your wealth to your best advantage. For more information contact your local office.

Antonio Rosa is the Associate Director of Blacktower in Lisbon, Portugal.

Blacktower Financial Management has been providing expert, localised, wealth management advice in Portugal for the last 20 years. We can help with specialist, independent advice on securing your financial future. Get in touch with us on (+351) 214 648 220 or email us at info@blacktowerfm.com.

Finally, successful wealth creation comes from correct asset allocation. This is all about where you place your investments – bonds, equities. Financial Security: A large part of our lives goes about in earning and saving money and the betterment of our loved ones in unforeseen situations.

By Dan Pimental Charitable Service from USA on 08 Jan 2022, 04:53